Current Work

Allston, MA

Co-GP, JV partnership with Hines. $130MM, 205 units of mixed-income housing with ground floor retail on a site formally occupied by a CVS. Construction commencing in 2026.

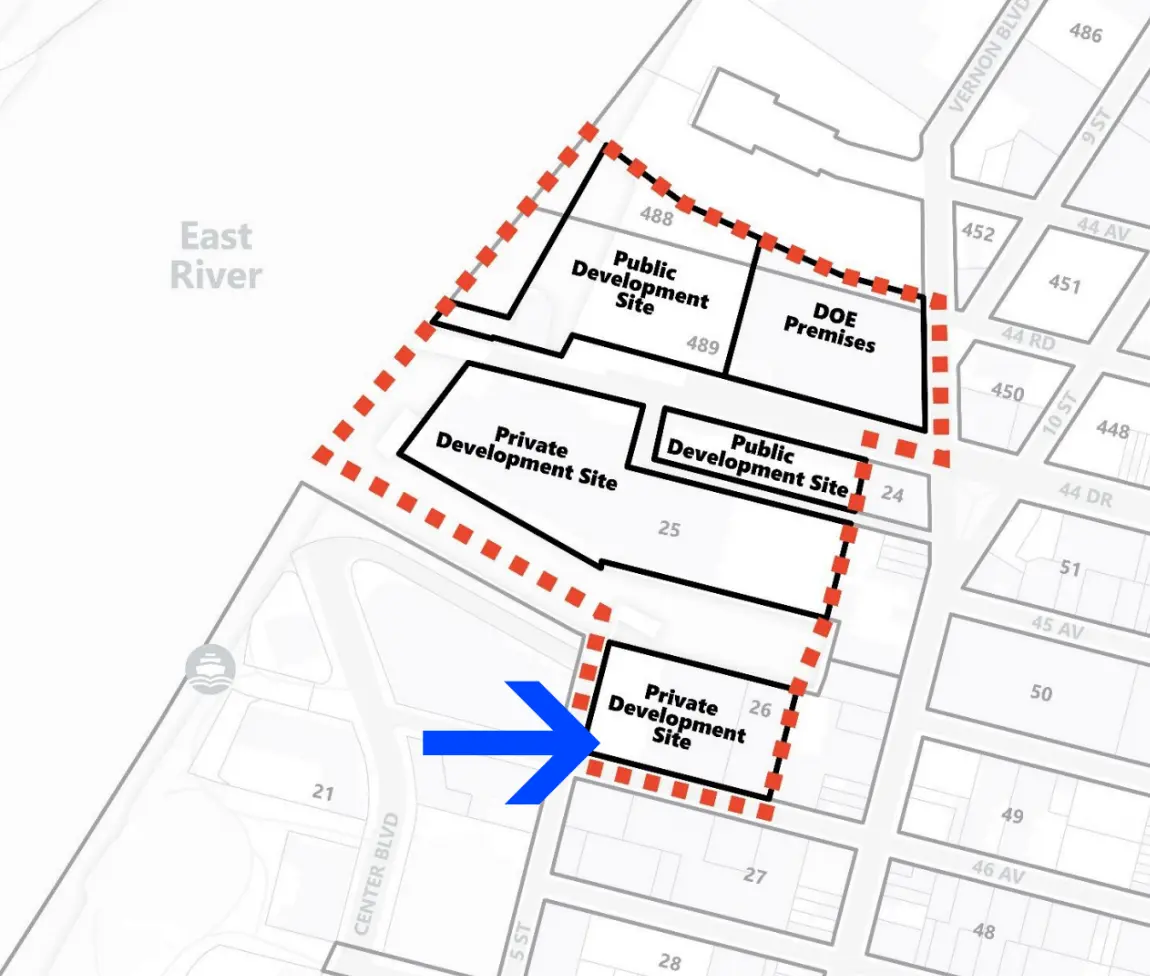

Queens, NY

Leading rezoning of a 70-year-old, 26,000 sf retail site located on a major boulevard, at the entrance of multiple subway lines into a 350,000 gsf mixed-use, mixed-income housing development that will include significant ground floor retail, parking andtake advantage of the city’s new housing policy to maximize efficiency and density. Expected to complete rezoning in 2026.

Snowball Development

Co-investor in GP Fund, member of advisory and investment committee.

The following projects were undertaken as a senior executive at

NYCEDC

JetBlue’s HQ

Led negotiations in cooperation with NY Empire State Development to keep and expand JetBlue’s HQ in Long Island City and NYC with a package of infrastructure and job training programs. JetBlue retained and expanded its employment base from 1300 to 4000 personnel.

Airport Leases at JFK/LGA

Negotiated and executed a 10-year extension of JFK/LGA airport lease with the Port Authority of NY/NJ on behalf of NYC to facilitate major redevelopment of JFK airport terminals– extracted financial and workforce/environmental policy benefits for the City of New York and NYCEDC.

Amazon HQ2

Co-led bid for the Amazon headquarters competition. Negotiated all financial terms in cooperation with NY State. Had Amazon not withdrawn its commitment, the project could have included 8M sf of new commercial space and 40,000 net new jobs for the City. Site assemblage included multiple private and public landowners in Long Island City.

World Wide Group

QLIC

400,000 gsf, 421 unit, $165MM mixed-use, multi-family development in Long Island City, achieved above market returns and returned over 90% of project equity at stabilization. Managing partner, led acquisition and execution, including procuring debt and equity.

110 Green Street

130-unit value-add residential community purchased as part of a 1031 replacement package. Developed and executed a repositioning plan in 2016, including debt, interior design, leasing, and branding.

Luna LIC

124-unit office to residential conversion purchased as part of a 1031 replacement package while under construction. Redesigned the interior design and branding and completed the execution in 2016.

AvalonBay Communities

Avalon White Plains

Purchased an under-utilized AT&T parking lot and private home, led special permit approval process, ground up $120MM, 400-unit mixed-income development, opened summer 2008.

Avalon Morningside Park

Led winning RFP competition and entitlements for the 300 -unit apartment mixed-income community, with $100MM of tax-exempt bond financing on a site leased from the Cathedral of St. John the Divine

Avalon West Chelsea

$230MM 700-unit mixed-income, mixed-use development assembled through a combination of a ground lease and the acquisition of High Line air rights. Included the national launch new apartment brand for AVB. Two buildings in one, with a complicated foundation and environmental remediation.